The recent decision by Indonesia to extend import tariffs on textiles is a significant move that reflects ongoing challenges within the global textile industry. These tariffs, initially introduced to protect domestic manufacturers from cheaper foreign imports, are now being extended to further support the local textile sector. This decision underscores the broader global trend of using import tariffs as a tool to bolster domestic industries facing economic difficulties.

Impact of Import Tariffs on the Textile Industry

Import tariffs on textiles can have a profound impact on the industry, influencing everything from pricing and competition to supply chain dynamics. For local manufacturers, these tariffs offer a reprieve from intense competition with cheaper imported goods, enabling them to capture a larger share of the domestic market. However, the benefits come with challenges, as the increased cost of imported raw materials can lead to higher production costs.

Manufacturers need to navigate this complex landscape carefully. While tariffs can protect local industries, they also necessitate strategic adjustments to ensure competitiveness. The impact on consumer prices, supply chain logistics, and overall industry growth will be closely monitored by stakeholders, as these factors are critical to the industry's recovery and long-term sustainability.

Strategies for Manufacturers to Address Import Tariffs

In light of the extended tariffs, manufacturers can adopt several strategies to mitigate potential negative impacts and capitalize on emerging opportunities:

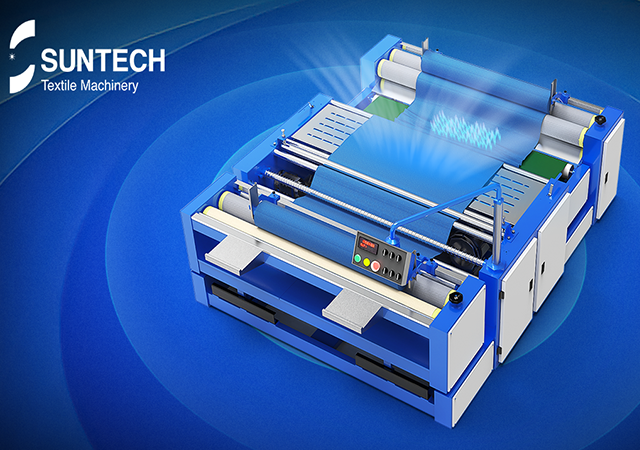

Innovation and Technological Advancements: Investing in technology and innovation can help manufacturers reduce production costs, improve efficiency, and maintain competitiveness despite higher material costs. For example, adopting advanced machinery like the SUNTECH Roll to Roll Fabric Relaxing Machine can optimize fabric handling, reduce tension, and enhance product quality.

Diversifying Supply Chains: Manufacturers should consider diversifying their supply chains to reduce dependency on imported materials that are subject to tariffs. Sourcing from alternative suppliers or investing in local production of raw materials can mitigate the impact of tariffs on production costs.

Value-Added Products: By focusing on value-added products that offer unique features or higher quality, manufacturers can justify higher prices and maintain profitability. This approach can also differentiate them from cheaper imports and cater to niche markets.

Sustainable Practices: Emphasizing sustainability in production processes can attract eco-conscious consumers willing to pay a premium for ethically produced goods. Sustainable practices can also align with global trends and regulations, providing a competitive edge in international markets.

Collaborative Efforts: Engaging in collaborative efforts with government bodies and industry associations can help manufacturers influence policy decisions and secure support for initiatives that strengthen the domestic textile sector.

Conclusion

The extension of textile import tariffs in Indonesia reflects a broader trend of using protectionist measures to support domestic industries. For manufacturers, this presents both challenges and opportunities. By adopting innovative strategies, diversifying supply chains, and focusing on value-added and sustainable products, manufacturers can navigate the complexities of import tariffs and position themselves for long-term success. The textile industry's ability to adapt to these changes will be crucial for its recovery and growth in an increasingly competitive global market.